Net Annual Income For Calendar Year 2026 Calculator Assessment Overview

Net Annual Income For Calendar Year 2026 Calculator Assessment Overview. Get accurate estimates for sections like 10 (13a), 80c, 80d,. Income tax calculator filing your income tax returns doesn’t have to be complex.

Surcharge (10% above ₹50 lakh): Education and health cess (4%): Get accurate estimates for sections like 10 (13a), 80c, 80d,.

Source: www.shutterstock.com

Source: www.shutterstock.com

2026 달력 연도 벡터 그림 주가 스톡 벡터(로열티 프리) 2151933159 Shutterstock Updated with budget 2024 changes. Compare new vs old tax regime, standard deduction of ₹75,000, latest tax slabs, deductions & exemptions.

Source: brennabrobbin.pages.dev

Source: brennabrobbin.pages.dev

Net Annual For Calendar Year 2024 Calculator Arden Brigida Get accurate estimates for sections like 10 (13a), 80c, 80d,. It also gives you a comparison of tax liability between the old and new tax regimes to help you decide which is more beneficial for you.

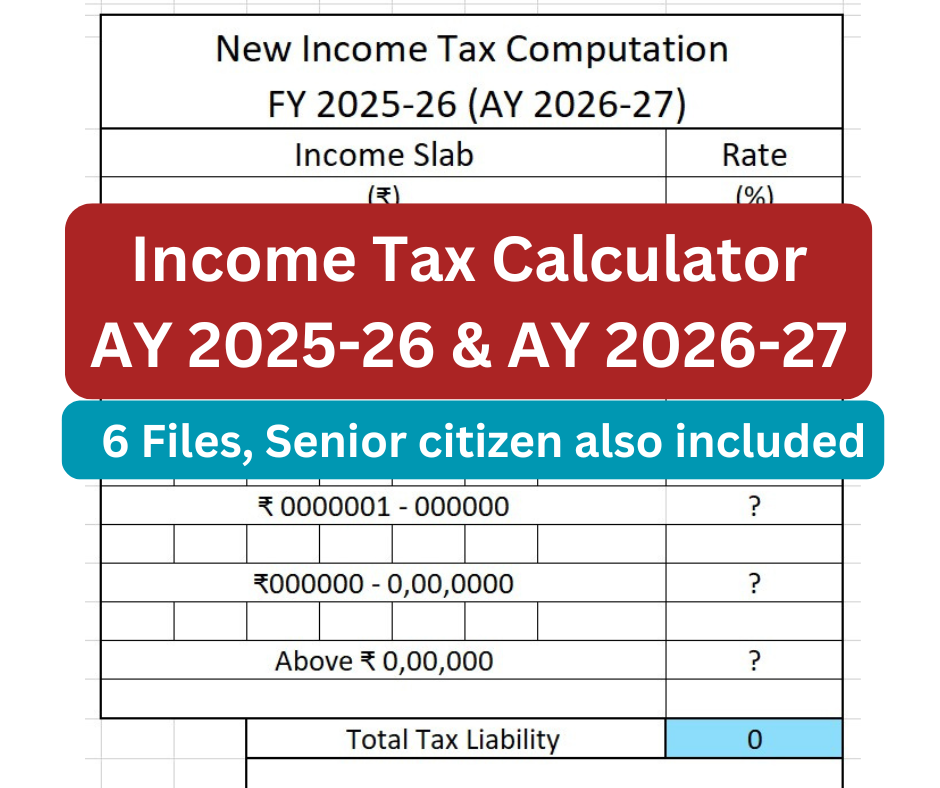

Source: moneyexcel.com

Source: moneyexcel.com

Download Tax Calculator FY 202526 (AY 202627) Surcharge (10% above ₹50 lakh): Education and health cess (4%):

Source: glentlopez.pages.dev

Source: glentlopez.pages.dev

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive Updated with budget 2024 changes. Free tax calculator for indian taxpayers.

Source: www.sunshineconsultants.co.in

Source: www.sunshineconsultants.co.in

Tax Calculator (FY 20252026) Sunshine Consultants Get accurate estimates for sections like 10 (13a), 80c, 80d,. Income tax calculator filing your income tax returns doesn’t have to be complex.

Source: isadorawdniren.pages.dev

Source: isadorawdniren.pages.dev

Net Annual For Calendar Year 2024 Lidia Corabel Updated with budget 2024 changes. Education and health cess (4%):

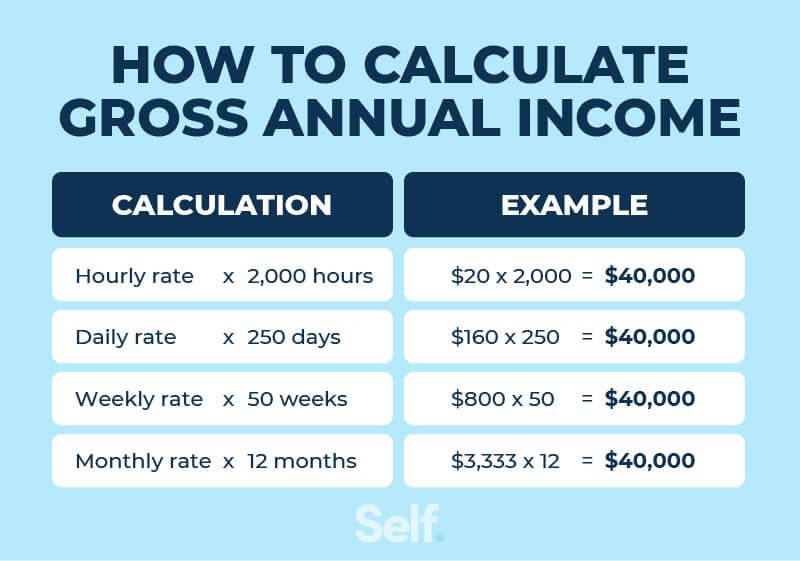

Source: www.self.inc

Source: www.self.inc

What Is Annual and How To Calculate It Self. Credit Builder. Get accurate estimates for sections like 10 (13a), 80c, 80d,. Education and health cess (4%):

Source: taxfilingschool.com

Source: taxfilingschool.com

Tax Calculator AY 202526 & AY 202627 For Salaried (Educational Compare new vs old tax regime, standard deduction of ₹75,000, latest tax slabs, deductions & exemptions. It also gives you a comparison of tax liability between the old and new tax regimes to help you decide which is more beneficial for you.

Source: uronowyuzxdblearning.z13.web.core.windows.net

Source: uronowyuzxdblearning.z13.web.core.windows.net

Calculator Worksheet How To Find Net For Begin Free tax calculator for indian taxpayers. Surcharge (10% above ₹50 lakh):

Source: www.careerprinciples.com

Source: www.careerprinciples.com

Net Formula Calculation & Examples Compare new vs old tax regime, standard deduction of ₹75,000, latest tax slabs, deductions & exemptions. Education and health cess (4%):

Source: cityofclovis.org

Source: cityofclovis.org

Yearly Calculator Top Sellers Surcharge (10% above ₹50 lakh): Income tax calculator filing your income tax returns doesn’t have to be complex.

Source: ettiqjulissa-9×0.pages.dev

Source: ettiqjulissa-9×0.pages.dev

Net Annual For Calendar Year 2024 Xylia Compare new vs old tax regime, standard deduction of ₹75,000, latest tax slabs, deductions & exemptions. Updated with latest budget changes, tax slabs, and deductions.